A relatively recent study shows that about 78% of Americans live from paycheck to paycheck. For many of them, financial hardship is a key source of stress and anxiety. However, it's always important to consider that stressing about a problem will never solve it.

First of all, you need to identify the cause of your financial hardship and then take measures to find the way out. If you look for extra money to get your finance back on track, opting for either payday or installment loans might be a good idea. However, it's essential to make it clear which type of loan will work best for you.

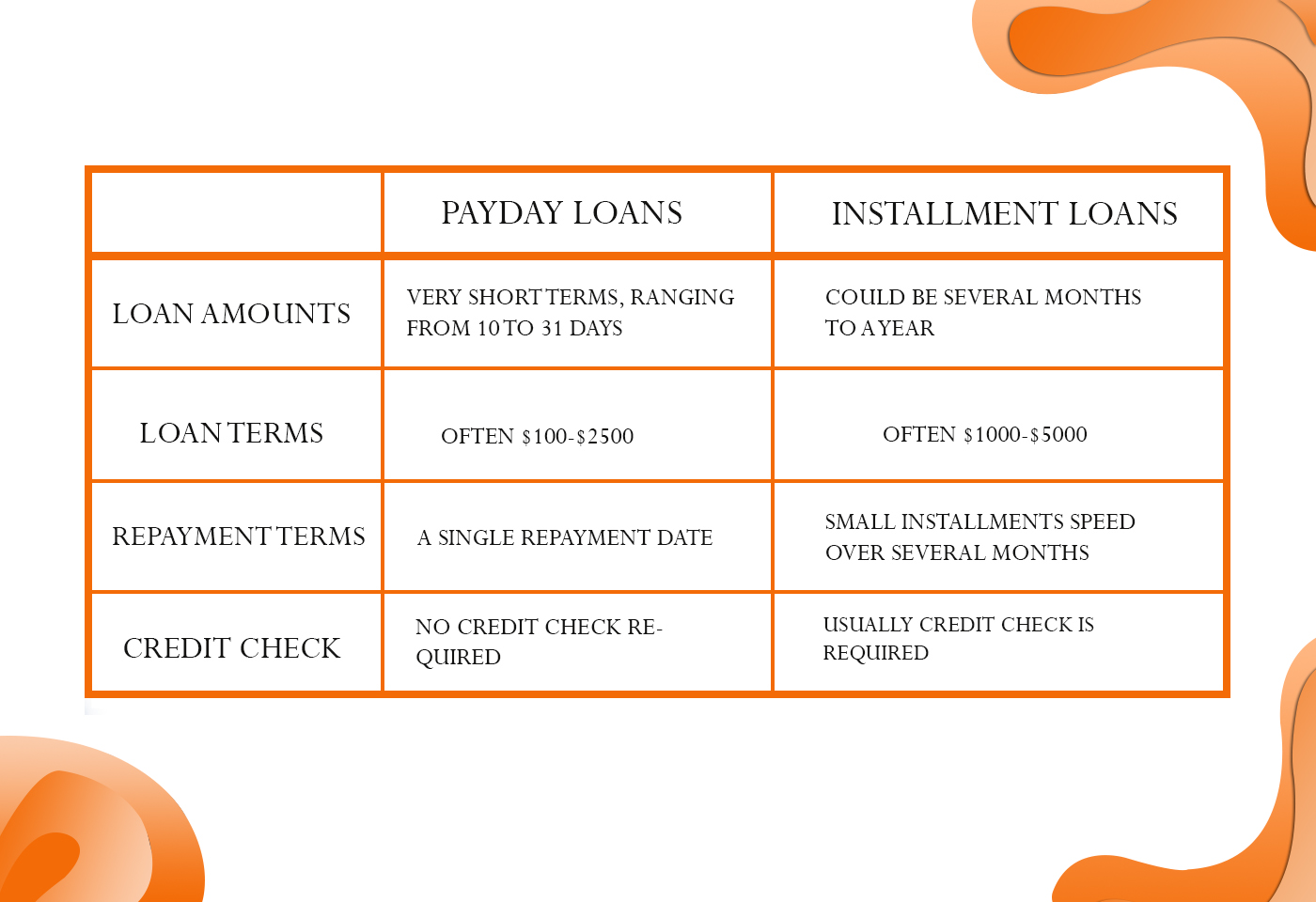

Payday Loans VS Installment Loans: What’s the Difference?

Occasionally your monthly paycheck doesn’t line up with unexpected bills or family emergencies. Your dilemma can be easily solved with cash-in-hand right now via a payday or installment loan. Considering differences between these two types of loans may come in handy to determine the right option.

What is a Payday Loan and How does it Work?

For smaller amounts and sudden emergencies, payday advances might be an ideal option. Payday loans are unsecured cash advances featuring small amounts. Once you take out a loan, you pay it off right away, typically upon your next paycheck. However, you have to settle your debt in a one-time payment, principal amount plus fees altogether. It’s simple: you get money, pay it back on your following payday and enjoy your debt-free life.

Benefits of a Payday Loan:

- A quick and simple way to pick up extra money,

- Easy to tackle financial stress in between paychecks,

- Getting a loan (bad credit loan) irrespective of credit history,

- Nothing to put up as collateral.

How Do Installment Loans Work?

While a payday loan allows you to borrow a relatively small amount of cash with a single repayment date, an installment loan spreads those repayments over several months. The amounts available to borrow typically range from $1000 to $5000. With more traditional credit forms, installment lenders look at your ability to repay a loan, credit history, income, and other personal circumstances. These checks tend to be a little tougher than those coming with payday lending.

When Do I need to Pick up an Installment Loan?

If you need to borrow a small amount, say up to $500, but won’t be able to make a full repayment upon your next paycheck, then an installment loan could be for you. It allows you to stagger your credit repayments in smaller installments. Unlike short-term loans, installment loans give you breathing space to plug the “financial hole” while you earn enough to repay it over a fixed period.

The principal of an installment loan is similar to a traditional unsecured loan, except that the timescale for repayment is much shorter. While bank loans usually have repayments between one and five years, installment loans give you a maximum of 12 months.

What's the Best Type of Loan for You?

Sometimes payday and installment loans roll into the same labor as emergency loans intended to help you make it to the next paycheck. But in fact, these two credit tools are designed to accomplish different financial goals. Payday loans are small financial relief with a short-term repayment schedule to time you over until your payday. Meanwhile, an installment loan could suit you if you look for a larger amount to pay it back over a longer period.

.jpg)

.jpg)

.jpg)

.jpg)